Table of Contents

Introduction:

Writing a check is a simple way to pay someone or a business. To write a check, you will need your checkbook and a pen. This article covers the most essential steps involved in writing a check, and it is concise and easy to understand.

Precautions of check writing:

Here are some precautions to keep in mind when writing a check:

Accurate Information:

Ensure that all the information written on the check is accurate, including the date, the payee’s name, and the amount in both numbers and words. Any errors can lead to payment issues or confusion.

Signature Security:

Safeguard your signature to prevent forgery. Only sign checks when necessary, and keep your blank checks in a secure place. Avoid leaving spaces for others to add unauthorized amounts.

Sufficient Funds:

Before writing a check, make sure you have enough funds in your bank account to cover the payment. Writing a check without sufficient funds can result in bounced checks, fees, and potential legal consequences.

Clear and Legible Writing:

Write the check neatly and legibly to avoid misinterpretation or alteration of the information. Illegible writing may cause delays or disputes when processing the check.

Protecting Personal Information:

Be cautious when providing personal information, such as your account number, on the check. Ensure that you are writing the check in a secure environment and avoid sharing unnecessary details.

Keep Track of Transactions:

Maintain a record of your check transactions in a check register or personal financial software. This allows you to reconcile your bank account, detect any discrepancies, and monitor your spending.

Secure Storage:

Store your unused checks in a secure location to prevent unauthorized access. Consider using a locked drawer or a safe to protect your checks from theft or misuse.

Destroy Unused Checks:

If you no longer need a particular checkbook, ensure that you destroy the remaining blank checks properly. Shred or tear them up to prevent someone else from using them.

Reporting Lost or Stolen Checks:

If your checks are lost or stolen, report it to your bank immediately. They can guide you on the necessary steps to protect your account and stop any unauthorized transactions.

Stay Informed:

Keep up to date with your bank’s policies, changes in check writing regulations, and potential scams targeting check users. Stay vigilant and educate yourself to avoid falling victim to fraudulent activities.

By following these precautions, you can minimize the risks associated with writing checks and ensure smooth and secure financial transactions.

How to write a check:

To write a check, follow these step-by-step instructions:

Step 01: Date the check

Start by writing the current date on the line provided at the top right corner of the check. Use the correct date format, such as “June 22, 2023.”

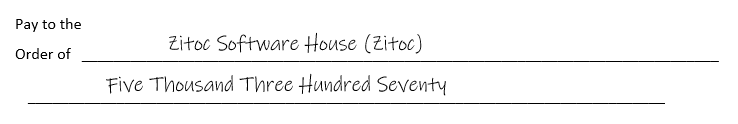

Step 02: Payee

On the line labeled “Pay to the Order of,” write the name of the person or organization you are paying. Be sure to write the full and accurate name of the payee. In this example, Zitoc Software House (Zitoc) is a business name.

Step 03: Numeric Amount

In the box preceded by the dollar sign ($), write the amount of the check-in numbers. Include both dollars and cents, if applicable. For example, if the check amount is $5370, write “5370.00” in the box.

Step 04: Written Amount

On the line below the payee’s name, write out the amount in words. Begin with the dollar amount, followed by “and,” and then write the cents portion as a fraction over 100. For example, if the check amount is $5370, write “Five Thousand Three Hundred Seventy.”

Step 05: Memo (optional)

If you want to include a note or reminder for yourself or the payee, you can use the memo line. This line is usually located in the bottom left corner of the check. Write a brief description, such as “Rent” or “For groceries” to indicate the purpose of the payment. In this case, we write “Website Development” which means we pay this check to the “Zitoc Software House (Zitoc)” business for “Website Development”.

Step 06: Sign the check

Sign the check in the bottom right corner using the same name associated with your bank account. Your signature authorizes the payment and makes the check valid.

Step 07: Account Number (optional)

Some checks may have a designated space for your bank account number. If required, write your account number on the check, usually near the memo line or in a specified area.

Step 08: Review and Accuracy

Before finalizing the check, carefully review all the information you have written, including the date, payee, numerical and written amounts, and your signature. Ensure everything is accurate and legible to avoid complications.

Step 09: Record keeping

Make a note of the check in your check register or personal financial software. Record the check number, date, payee, and the amount to keep track of your expenses and maintain an accurate account balance.

Step 10: Delivery or Deposit

Deliver the check to the intended recipient or deposit it into your bank account. Keep a copy of the check or a record of the transaction for your records.

Remember, it is important to have sufficient funds in your bank account to cover the amount of the check. Writing a check without enough funds can result in bounced checks and potential fees. Always double-check the accuracy of the information on the check to ensure a smooth and successful financial transaction.

Different parts of the check:

There are some other parts of the check which are mentioned below in detail.

-

The Bank details on the check

At the top left hand, there is a pre-defined bank name, logo, and address. All these details are already written where anyone’s account is registered.

.

-

Check Number

The check number is the unique pre-defined 6 series or different numbers at the top right-hand side of the check. The check number is essential for tracking the person/company for whom the check has been drawn out.

-

Bank security code

The bank security code is the unique security code of every bank mentioned at the bottom of the check.

-

Customer Details

This portion of the check contains customer details i-e an IBAN for individual customers. IBAN is nothing new but a modified format of your bank account number for international recognition. IBAN has a fixed length containing the first two digits of the country code, the next two digits of the check digits, the next 4 digits of the bank code, last 16 digits of your account number.

Tips for writing a check:

Here are five essential tips for writing a check:

Fill in the check completely:

Ensure that all the necessary fields on the check are filled in correctly. This includes the date, recipient’s name, payment amount (both in numbers and words), and your signature. Incomplete or missing information may cause delays or confusion.

Write legibly and clearly:

Use clear and legible handwriting when writing a check. It’s important to make sure that the recipient’s name, payment amount, and other details are easily readable to avoid any misinterpretation or errors.

Double-check the payment amount:

Take an extra moment to verify the payment amount you’re writing on the check. Mistakes in the amount can result in overpayment or underpayment, which can lead to complications or financial discrepancies.

Maintain accurate records:

Keep a record of the checks you write in your check register or personal financial management system. This will help you keep track of your expenses, reconcile your accounts, and detect any discrepancies or unauthorized transactions.

Use a secure writing instrument:

Always use a pen with indelible ink to write a check. Avoid using pencils or erasable ink, as they can be easily altered or erased. Using a secure writing instrument adds an extra layer of protection against fraud or tampering.

Remember, each financial institution may have its specific guidelines or requirements for writing checks, so it’s a good practice to familiarize yourself with their instructions or consult with your bank if you have any doubts or questions.

People also ask:

-

What is the most important part of writing a check?

The most important part of writing a check is ensuring accuracy and completeness in all the essential details. This includes:

Payment Amount: The payment amount must be accurate and specified in both numerical and written form. Any mistakes in the amount can lead to financial errors or disputes.

Payee Information: The name of the recipient or payee should be written accurately to ensure that the funds go to the intended individual or organization. Any inaccuracies or misspellings may cause confusion or delays.

Signature: Your signature on the check is vital as it confirms your authorization and makes the check legally valid. Without a valid signature, the check may be considered invalid or not acceptable for payment.

While all parts of a check are important, these three elements—payment amount, payee information, and signature—are particularly crucial to ensure the check is properly processed and your financial transactions are accurate. -

Can someone steal your bank info from a check?

The risk of someone stealing your bank information from a physical check is relatively low compared to other forms of identity theft or fraud. However, it’s still important to take precautions to protect your financial information.

-

What makes a check invalid?

It’s important to note that the specific rules and regulations regarding check validity may vary by country and financial institution. If you encounter an issue with a check, it’s advisable to contact your bank for guidance and clarification.

-

What are the three rules for check writing?

The three essential rules for check writing are as follows:

Consistency between the written and numerical amounts: The first rule is to ensure consistency between the written and numerical amounts on the check. The payment amount should be written both in numbers and words, and these two representations must match exactly. For example, if you write “One hundred dollars and 50/100” in words, the numerical amount should be “100.50.”

Properly authorized signature: The second rule is to have a properly authorized signature on the check. Your signature confirms that you authorize the payment and makes the check legally valid. It’s crucial to sign the check using your official signature as it appears on file with your bank. Some banks may also require additional precautions, such as using specific ink colors or styles for the signature.

Accurate and complete information: The third rule is to ensure that all necessary information is accurate and complete. This includes the date, payee or recipient’s name, payment amount (both in numbers and words), and any additional details required by your bank or financial institution. Any inaccuracies, missing information, or alterations may lead to the check being considered invalid or rejected by the bank.

Following these three rules helps ensure that your checks are properly filled out, valid, and can be processed smoothly by the recipient and your bank. It’s important to be attentive and double-check the information on each check to avoid any errors or potential issues. -

What if I mess up my signature on a check?

Your bank will not issue the check. If the mistake is significant or you are unsure of the validity of your signature, you can void the check. Write the word “VOID” in large, clear letters across the face of the check. Keep the voided check for your records, but it will no longer be used for payment.

-

Should you put the address on the checks?

Including your address on a personal check is generally optional, and it’s not a requirement for the check to be valid or processed. However, there are some situations where including your address on a check can be beneficial:

Identity verification: Including your address on a check can help verify your identity. It provides additional information that can match the address on file with your bank or the recipient’s records, adding a layer of confirmation.

Return mail: If the recipient is unable to deposit or cash the check for any reason, having your address on the check can help facilitate its return to you. It allows the recipient or their bank to return the check by mail in case of any issues or complications.

Record-keeping: Including your address on a check can serve as a record for both you and the recipient. It can help in organizing and referencing payment information, especially if you have multiple accounts or transactions to track.

Personal preference: Some individuals prefer to include their address on checks for personal or business reasons. It can add a level of transparency and provide contact information in case the recipient needs to reach you. -

Can someone get into your bank account with a check?

No, someone cannot directly access your bank account by simply having a physical copy of one of your checks. While a check does contain your bank account number and routing number, that information alone is not sufficient to gain unauthorized access to your account.

However, it’s still important to take precautions to protect your banking information. -

Are checks safer than debit cards?

The safety of checks versus debit cards depends on various factors, and it’s important to consider the advantages and potential risks associated with each payment method. Here are some points to consider:

Checks:

Advantages of a check:

Control: With checks, you have more control over when and how much money is withdrawn from your account since you initiate the payment.

No risk of direct account access: Unlike debit cards, checks do not expose your bank account information to the same extent. The account details are not directly accessible through a physical check.

Risks of a check:

Physical security: Checks can be lost, stolen, or intercepted, which poses a risk if someone gains access to the check and tries to manipulate or misuse the information.

Fraud potential: Checks can be subject to alteration or forgery if not handled properly or if your information falls into the wrong hands. However, banks have security measures in place to detect and prevent check fraud.

Debit Cards:

Advantages of a debit card:

Convenience: Debit cards provide a convenient and quick way to make purchases or withdraw cash at ATMs.

Enhanced security features: Debit cards often come with security features such as PIN authentication and fraud protection programs offered by the card issuer.

Risks of a debit card:

Direct account access: Debit cards are directly linked to your bank account, and if compromised, unauthorized individuals may have the ability to make unauthorized transactions or access your funds.

Skimming and online threats: Debit card information can be compromised through skimming devices at ATMs or through online scams, potentially leading to unauthorized transactions.

To enhance the security of both payment methods, it’s important to follow best practices such as safeguarding your checks, protecting your debit card PIN, monitoring your account activity, and promptly reporting any suspicious transactions to your bank.

In general, both checks and debit cards have their own set of risks and safety measures. It’s advisable to consider your personal preferences, habits, and the security features provided by your financial institution when deciding which payment method to use in different situations.

Watch the short video tutorial:

Article Summary:

By following these steps and double-checking the accuracy of the information, you can ensure that your check is properly filled out and ready for processing.

Remember to use indelible ink and store your blank checks securely to prevent unauthorized access or alterations. If you make a mistake on a check, consider voiding it or contacting your bank for guidance on the best course of action.

Writing checks can become more familiar and comfortable with practice. If you have any specific requirements or guidelines from your bank, be sure to follow them as well.

References:

- https://www.huntington.com/learn/checking-basics/how-to-write-a-check

- https://www.thebalancemoney.com/how-to-write-a-check-4019395

- https://www.wikihow.com/Write-a-Check

- https://www.bankrate.com/banking/checking/how-to-write-a-check/

- https://www.capitalone.com/learn-grow/money-management/how-to-write-a-check/

- https://www.forbes.com/advisor/banking/how-to-write-a-check/

- https://www.nerdwallet.com/article/banking/how-to-write-a-check

- https://www.wafdbank.com/blog/consumer-tips/how-to-write-a-check

Valuable info. Fortunate me I found your web site

by chance, and I’m surprised why this accident didn’t

came about in advance! I bookmarked it.

I go to see everyday a few sites and websites to read

articles, but this website provides quality based content.

Your post was not just informative, but also a joy to read. Your writing style is exceptional.

Reading your post was the highlight of my day. Your insights are always so valuable and well-presented.

This is some reliable stuff. It took me some time to

find this internet site but it was worth the time. I noticed this

content was buried in google and not the number one spot.

This site has a lot of nice stuff and it doesnt deserve to be burried in the searches like that.

By the way I am going to save this web site to my favorites.

Great post. I used to be checking continuously this weblog and I’m

impressed! Extremely helpful information specifically the remaining phase 🙂 I care

for such info much. I was seeking this particular info for a long time.

Thank you and good luck.

Whats up very nice site!! Man .. Excellent .. Superb ..

I will bookmark your web site and take the feeds also?

I’m satisfied to find so many useful info right here within the post,

we’d like work out more techniques in this regard, thank you

for sharing. . . . . .

This is a great and informative article on how to write a check. It covers all the essential steps and provides clear and concise instructions. I especially appreciate the tips on writing checks safely and securely, such as using black ink and never writing a check for more money than you have in your account. Overall, this is a valuable resource for anyone who needs to learn how to write a check.

A great blog here! Penny Objects

This is a great, clear, and concise guide to writing a check! It’s especially helpful for those who are new to using checks or haven’t done so in a while. I particularly appreciate the tip about double-checking the amount you write both in numbers and in words to avoid errors. Thanks for sharing!

Hello There. I found your blog the use of msn. This is a really smartly written article.

I will make sure to bookmark it and come back to learn more of your useful information. Thank you for the post.

I will definitely comeback.

I am regular visitor, how are you everybody? This post

posted at this website is genuinely fastidious.

What’s up to all, the contents present at this web site are genuinely remarkable for people experience, well, keep up the nice work fellows.

I absolutely love your blog and find nearly all of your post’s to be exactly

I’m looking for. Would you offer guest writers to write content in your

case? I wouldn’t mind producing a post or elaborating on many

of the subjects you write about here. Again, awesome site!

Hi there to all, how is the whole thing, I think every one is

getting more from this website, and your views are

nice for new people.